Find out when you will have enough money for what you want and then have fun buying it!

Always have money for your needs by knowing the foreseeable future of your bank account balance.

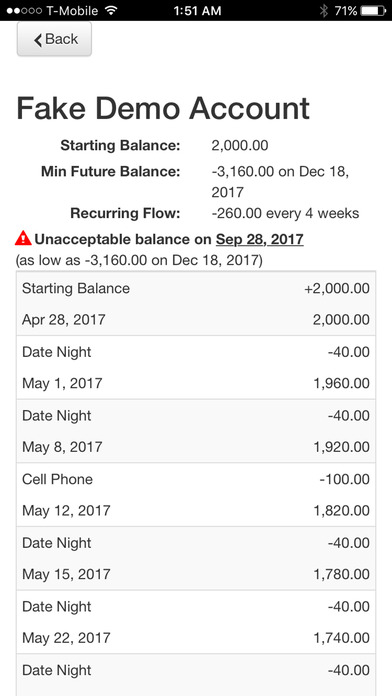

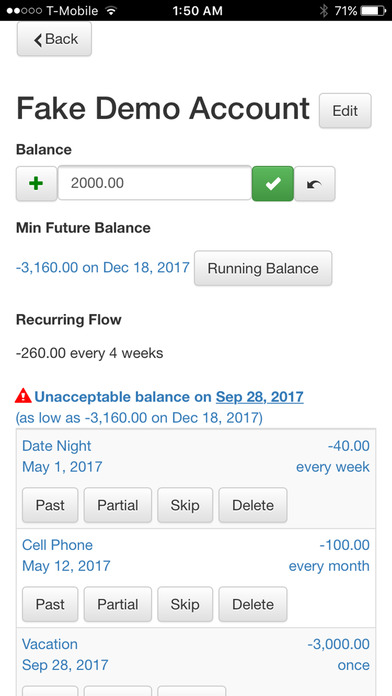

If theres a shortage coming up, know precisely when and how much it is so you can plan accordingly.

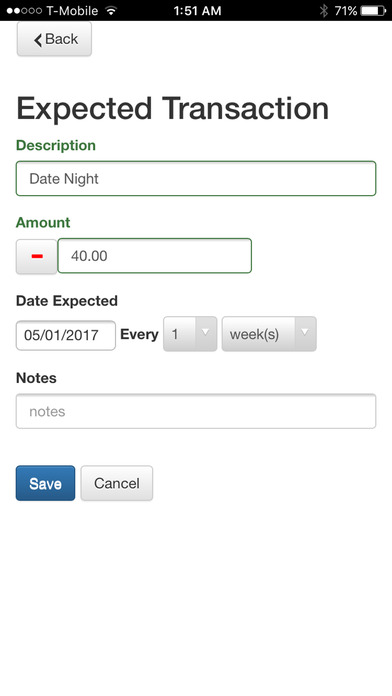

1. Add your future income, expenses, and wish list (bills, uncleared checks, common expenses, vacations, etc.).

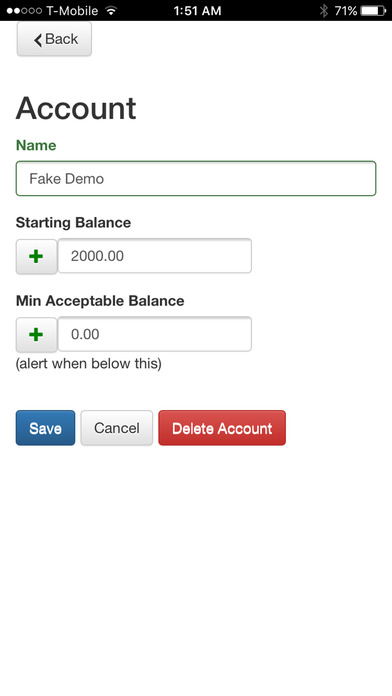

2. Fill in your bank account balance.

3. See where you stand now and in the future: when you can afford wish list items, how much youre over or under each month, how much time you have before you’ll come up short, etc.

Stop being overwhelmed trying to keep up with categorizing every transaction.

Become a successful provider for your family by always being able to pay bills on time, save up for vacations, and know where you stand.

When you add the transactions you expect to happen, along with your bank account balance, Future Balance will tell you how much extra money you have! If youll come up short, it will tell you when and by how much.

When you add a transaction without a date (marked as ASAP), it will figure out the date for you. You can prioritize these ASAP transactions.

Its unlike other apps that give you the daily work of going through every transaction that shows up in your bank account, categorizing them, etc. With Future Balance, whats past is past. It is focused on the future. When you want to see the past, look at your banks web site, mint.com, or another tool.

Your information is safe! Future Balance doesnt even ask for permission to connect to the internet! Future Balance never asks for your banks name or account number. Future Balance and its affiliates never use your data or share it with anyone (unless legally required). It does not contact your bank for any reason. In fact, the data never even leaves your device!

For utilities or other bills that may change each month, you can estimate the amount. Often (especially utility companies) have an "equal payment" plan that evens out the payments throughout the year, which can simplify the work.

If you dont use direct deposit for your paychecks, you may want to put the latest possible date that youd deposit it to be safe.

For bills that are automatically withdrawn, you may want to put the soonest date that it could come out of your bank account to be safe.

For groceries and other spending that changes constantly, estimate the amounts.

What may work even better is to set up automatic transfers to a separate bank account (or a few) for that spending.

If you do that, you can see how much you have in those areas by simply looking at their dedicated bank account balance.

This works because debit cards (and ATMs) show up immediately in your bank account.

When you write a check, you can add the future cashing of it as an expected transaction.

We love feedback and suggestions! Please send feedback to [email protected] or post on "Pabst Software" on Facebook!